november child tax credit not received

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon. In order to check the status of your payments or see if you will be getting a.

Enroll And Claim The Child Tax Credit By Nov 15

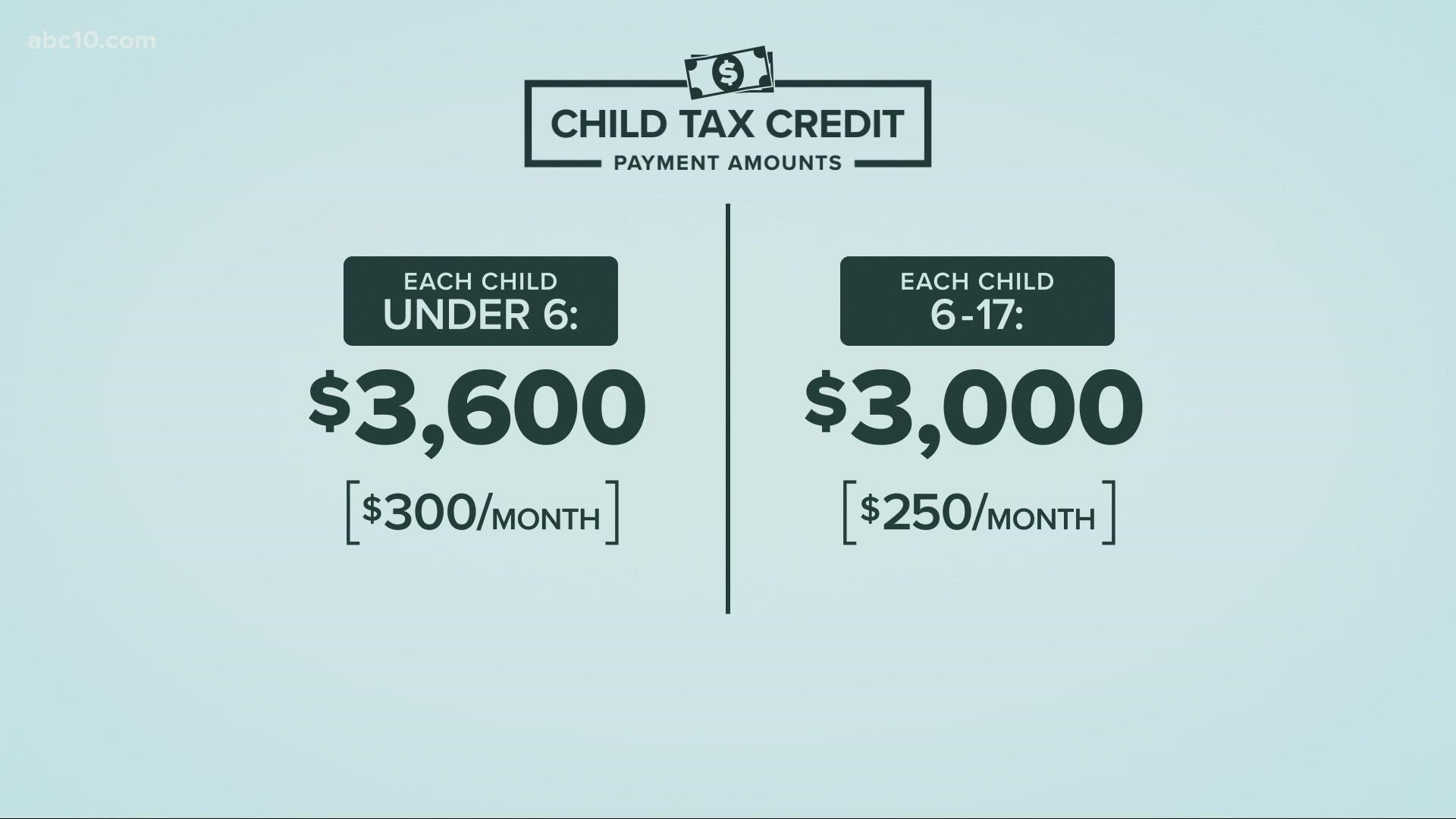

Up to 300 dollars or 250 dollars depending on age of child.

. Child tax credit payments set to go out Monday. 2 days agoNovember 11 2022 0939 PM. Enhanced child tax credit.

IR-2021-222 November 12 2021. DWP claimants will receive their second Cost of Living payment by 23. As many as 9 million or 10 million people who have not yet received these payments.

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Eligible families who did not opt out of the monthly payments are. Could be next-to-last unless Congress acts.

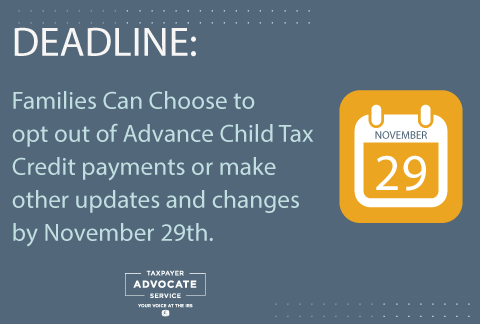

If one only spouse unenrolls they will receive half the joint payment they were supposed to receive with. October 15 PAID. November deadlines loom to claim credits.

The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5. Your marital status and whether or not your children live with you for at least 6 months out of. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021.

Up to 300 dollars or 250 dollars depending on age of child. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Families signing up now will normally receive half of their total Child Tax Credit received o n Dec.

Households that received the advance CTC payments should have gotten half. November child tax credit payments are expected to be issued in the coming weeks. Instead of calling it.

The payment for the. It could be extended through 2022 under Democrats 175 trillion social. Up to 300 dollars or 250 dollars depending on age of child.

Parents with children ages six to 17 received up to 250 per month per child for a total of 1500. 1200 sent in April 2020. 1 day agoThe child tax credit payments of 250 or 300 went out to eligible families monthly from July to December 2021.

Depending on the age of the children some families received up. The percentage depends on your income. Low-income families who have not received advance payments because they do not typically file a tax return have until Monday night Nov.

The fifth installment of the Child Tax Credit advance payments will be sent out on November 15. If you have a child aged 6-17 you will receive 250 per qualifying dependent child. Over 8 million benefit claimants to receive 324 this month as part of Cost of Living support.

The bill was enacted in March to help families get back on their feet amidst the Covid. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. November 15 SHOULD BE PAID.

The IRS Free File tool is scheduled to stay open until Nov. Both spouses need to opt out if married and filing jointly the IRS said. 15 to sign up to receive a lump sum.

1 day agoYou will be eligible for the second cost of living payment of 324 if you received or later receive for any day in the period August 26 2022 to September 25 2022 either. Families with children are eligible for the child tax credit. 17 for people who still need to file 2021 tax returns.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Irs Sending Letters To Over 9 Million Potentially Eligible Families Who Did Not Claim Stimulus Payments Eitc Child Tax Credit And Other Benefits Free File To Stay Open Until Nov 17

Child Tax Credit Delayed How To Track Your November Payment Marca

The Child Tax Credit Is Helping Clevelanders But Some Families Have Missed Out News Ideastream Public Media

One Week Until November Child Tax Credits Are Paid Out What Time You Ll Get Them Explained The Us Sun

Deadline To Claim Child Tax Credit Up To 1 800 Per Child Coming Up Nov 15 Dollars And Sense Abc10 Com

Expanded Child Tax Credit Registration Deadline Nov 15

/cloudfront-us-east-1.images.arcpublishing.com/gray/UI6ILF3TYZEQND3RU2UEGASAQ4.jpg)

Parents Still Have Time To Claim Their Expanded Child Tax Credit By Nov 15

Stimulus Update When Will The Child Tax Credit Payment For November 2021 Get To You Gobankingrates

Make Updates To Your Advance Child Tax Credit Payment By The November 29th Deadline Tas

Child Tax Credit Update Next Payment Coming On November 15 Marca

Parents Have Just Hours To Opt Out Or Make Changes To Child Tax Credits Or Face Paying Back The Irs Next Year The Us Sun

Using The Child Tax Credit To Boost Your Banking

Child Tax Credit Enrollment Deadline Is November 15 Cnw Network

The Senate S Expansion Of The Child Tax Credit Leaves Out Kids Who Need It Most Prosperity Now

Where Is My Child Tax Credit Netspend

Child Tax Credit Fight Reflects Debate Over Work Incentives Wnep Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

November Child Tax Credit Last Chance For Parents To Sign Up

When Is My November Child Tax Credit Coming Irs Payments Wtsp Com