unlevered free cash flow vs free cash flow

Unlevered free cash flow is the money the business has. Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes.

Free Cash Flow Yield Formula And Calculation

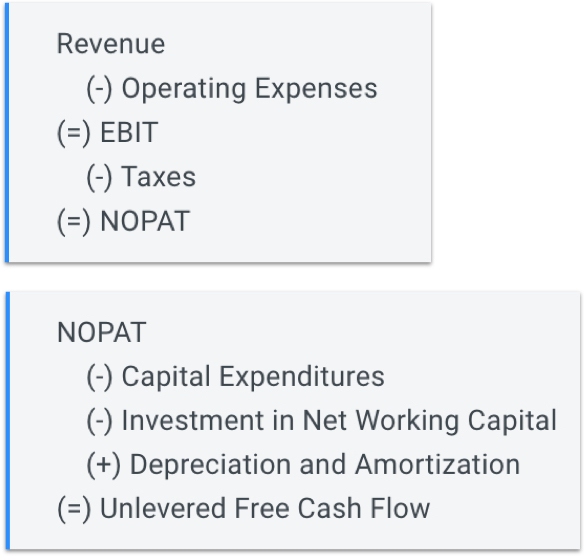

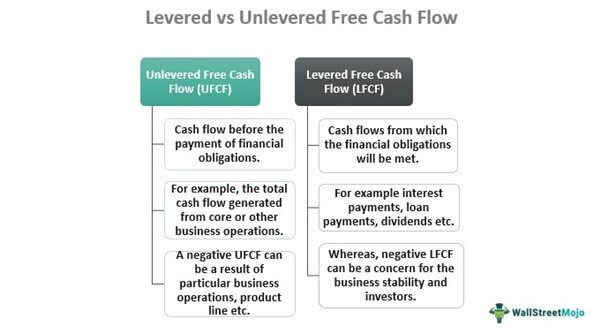

The key difference between Unlevered Free Cash Flow and Levered Free Cash Flow is that Unlevered Free Cash Flow excludes the impact of interest expense and net debt.

. Levered cash flow is the amount of cash a business has after it has met its financial obligations. Unlevered means without leverage because it doesnt take into account the cost of any debt that may be used in operating a business. What is Levered Free Cash Flow.

Non-GAAP unlevered free cash flow was 421 million vs. In other words it deducts. Levered cash flow is the amount of money your business has left over after paying all bills and other financial obligations including operating expenses interest payments etc.

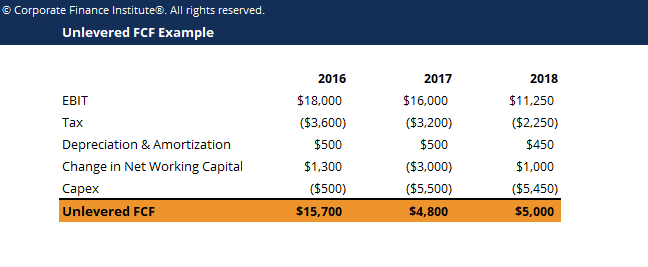

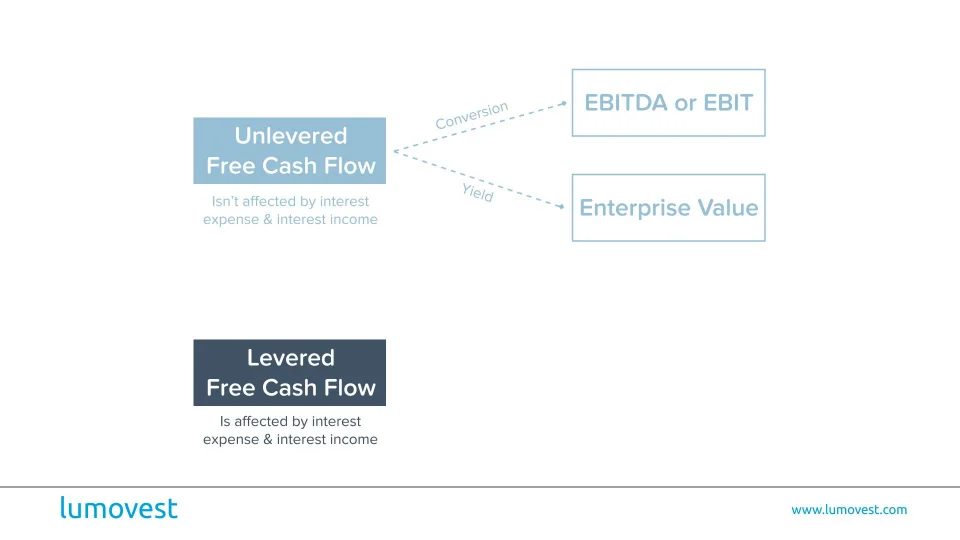

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. 473 million a year ago. As you can see the equation for unlevered free cash flow is not nearly as extensive as the one for levered free cash flow.

Cash and cash equivalents of 2005 million investments in marketable securities of 277. Free Cash Flow Operating Cash Flow CFO Capital Expenditures Most information needed to compute a companys FCF is on the cash flow statement. Unlike levered free cash flow.

Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for. It is the cash flow available to all equity. I invite you to subscribe to my YouTube channel at the link below.

The average consumer may not ever see or need to know this amount. The basic difference is that Levered Free Cash Flow represents the cash flow available only to the common shareholders in the company rather than all the investors. Debt is typically in the form of bonds or.

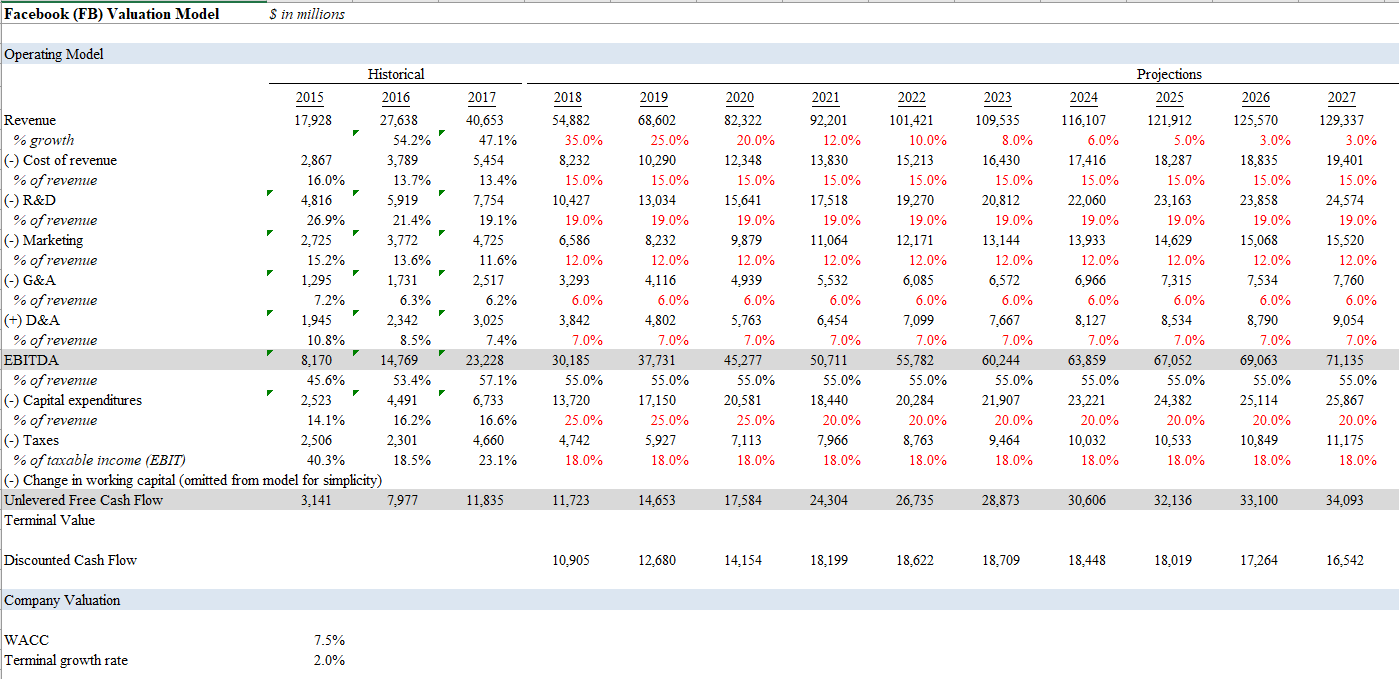

UFCF EBITDA CAPEX working capital taxes. The unlevered free cash flow is of interest to investors and shareholders who use these numbers from a companys financial statement to determine discounted cash flow DCF or future. Unlevered free cash flow UFCF is used at a high level to determine the enterprise value of a business.

In order words the levered free cash flow represents the residual cash remaining once all payments related to debt such as interest have been deducted.

Unlevered Free Cash Flow Ufcf Meaning Formula Example

Unlevered Fcf Template Download Free Excel Template

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Unlevered Free Cash Flow Ufcf Guide Formula Examples

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐫𝐞𝐞 𝐂𝐚𝐬𝐡 𝐅𝐥𝐨𝐰 𝐅𝐂𝐅 𝐚𝐧𝐝 𝐇𝐨𝐰 𝐭𝐨 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐞 𝐈𝐭 Accounting Drive

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

Unlevered Free Cash Flow Definition Examples Formula Wall Street Oasis

Free Cash Flow Yield Formula And Calculation

How To Calculate Levered Free Cash Flow Gocardless

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

Fcff Vs Fcfe Top 5 Useful Differences With Infographics

Free Cash Flow Formula Calculator Excel Template

Unlevered Free Cash Flow Ufcf Meaning Formula Example

Consistency Of Free Cash Flow Ratios Lumovest

Unlevered Free Cash Flow What Goes In It And Why It Matters Youtube